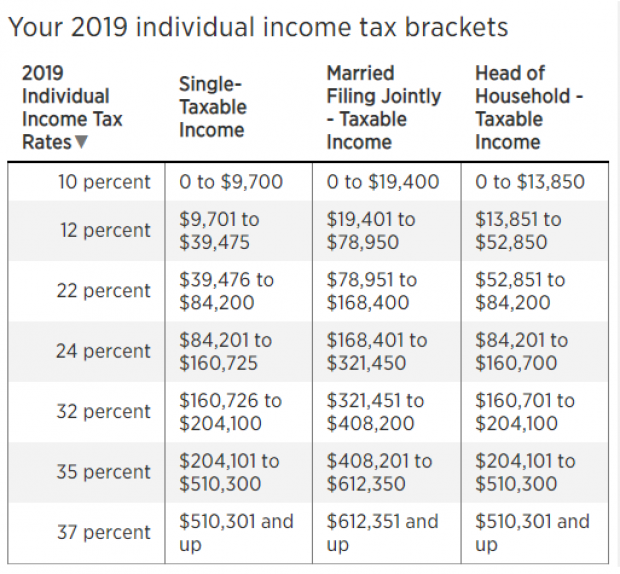

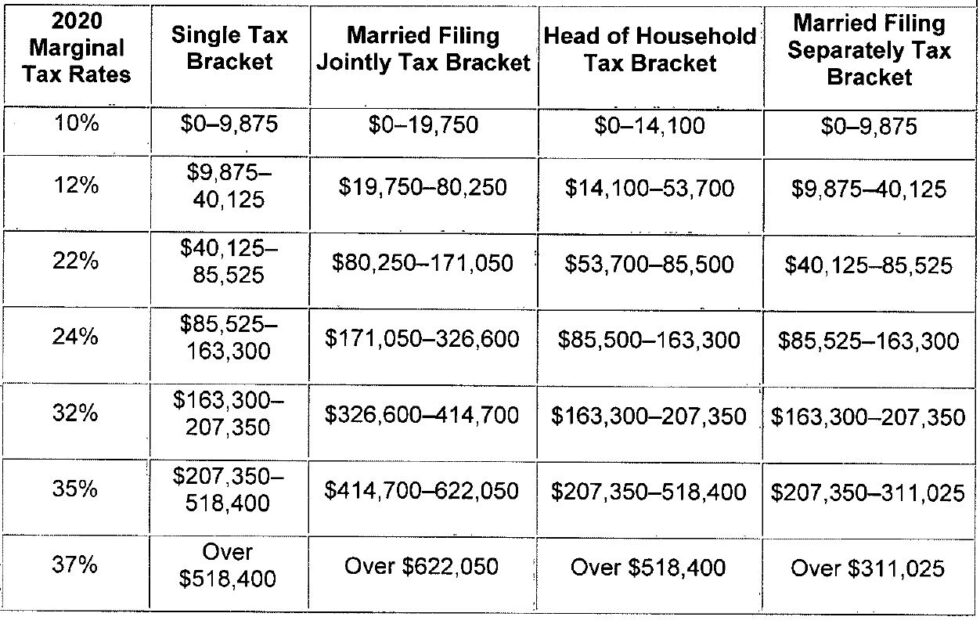

Meanwhile, to maintain the progressivity of the tax system, the tax rate for individuals earning PHP8,000,000 and above annually will be maintained at 35 percent.As you review the tables below, keep in mind that your bracket depends on your taxable income and filing status. The lowest rate is 10 for incomes of single individuals with incomes of 11,000 or less (22,000 for married couples filing jointly). This page explains how these tax brackets work, and includes a Federal income tax calculator for estimating your tax liability. Income brackets will also return to their previous ranges, indexed for inflation. The revised tax schedule beginning Janureduces personal income taxes for those earning PHP8,000,000 and below, compared to the initial tax cuts for Januto December 31, 2022. 22 for incomes over 44,725 (89,450 for married couples filing jointly) 12 for incomes over 11,000 (22,000 for married couples filing jointly). The Federal Income Tax consists of seven marginal tax brackets, ranging from a low of 10 to a high of 39.6. Individual tax rates are set to revert to their 2017 amounts. Individuals with an annual taxable income below PHP250,000 are still exempted from paying personal income taxes under the adjusted tax rates. Income brackets adjust every year to account for inflation. For tax year 2022, the lowest 10 rate applies to an individual's income of 10,275 or less, while the highest 37 rate applies to an individual's income of 539,900 or more. For example, in 2022, a single filer with taxable income of 100,000 will pay 17,836 in tax, or an average tax rate of 18. California has the highest state income tax at 13. There are seven tax rates that apply to seven brackets of income: 10, 12, 22, 24, 32, 35, and 37. For help with your withholding, you may use the Tax Withholding. All Table unless noted otherwise have be updated to include tax changes through January 1, 2023. The information you give your employer on Form W4. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn.

We want our taxpayers to reap the fruits of their labor while enabling them to contribute their fair share to national development,” said Finance Secretary Benjamin Diokno. States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal government’s. For employees, withholding is the amount of federal income tax withheld from your paycheck. “The TRAIN law adjusted personal income taxes and fixed the inequity of our tax system. Majority of taxpayers will receive further personal income tax cuts beginning Janupursuant to Republic Act 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) law, which, among others, adjusted personal income tax rates, to make the tax system simpler, fairer, and more efficient. 28/12/22 TRAIN law to further reduce personal income taxes in 2023 onwards.

0 kommentar(er)

0 kommentar(er)